10 Simple Techniques For Whole Farm Revenue Protection

Table of ContentsSome Known Details About Whole Farm Revenue Protection Excitement About Whole Farm Revenue ProtectionThe Best Strategy To Use For Whole Farm Revenue ProtectionWhole Farm Revenue Protection - TruthsHow Whole Farm Revenue Protection can Save You Time, Stress, and Money.Not known Details About Whole Farm Revenue Protection Our Whole Farm Revenue Protection Statements

Farm and cattle ranch property insurance policy covers the assets of your farm as well as cattle ranch, such as livestock, equipment, buildings, setups, as well as others. These are the typical coverages you can get from ranch as well as cattle ranch residential property insurance policy.Your ranch and ranch makes use of flatbed trailers, confined trailers, or utility trailers to haul goods and devices. Industrial automobile insurance policy will certainly cover the trailer but only if it's attached to the insured tractor or truck. If something occurs to the trailer while it's not affixed, then you're left on your very own.

Workers' settlement insurance policy gives the funds a worker can make use of to acquire medicines for a work-related injury or condition, as prescribed by the physician. Employees' settlement insurance covers rehabilitation.

Some Known Incorrect Statements About Whole Farm Revenue Protection

You can guarantee yourself with workers' settlement insurance. While acquiring the plan, service providers will offer you the freedom to consist of or omit on your own as an insured.

Whole Farm Revenue Protection - An Overview

The appropriate one for your ranch vehicle as well as situation will differ depending upon a number of factors. Many farm insurance service providers will likewise provide to write a farmer's car insurance policy. It can be useful to couple plans with each other from both a coverage as well as cost perspective. In some circumstances, a ranch insurance policy service provider will just provide certain sorts of car insurance policy or guarantee the auto dangers that have operations within a particular range or range.

Whatever carrier is creating the farmer's automobile insurance coverage policy, heavy and also extra-heavy vehicles will certainly need to be placed on a commercial automobile plan. Trucks labelled to an industrial farm entity, such as an LLC or INC, will certainly need to be positioned on a commercial plan despite the insurance policy carrier.

If a farmer has a semi that is utilized for carrying their own ranch items, they might have the ability to include this on the very same industrial auto plan that insures their commercially-owned pickup. Nevertheless, if the semi is used in the off-season to carry the goods of others, most typical farm as well as industrial car insurance coverage service providers will not have an "hunger" for this type of risk.

An Unbiased View of Whole Farm Revenue Protection

A trucking plan is still a commercial automobile plan. The providers who offer protection for operations with automobiles made use of to transport goods for 3rd celebrations are generally specialized in this kind of insurance coverage. These kinds of procedures produce greater threats for insurance firms, larger insurance claim quantities, over at this website and also a better seriousness of cases.

A skilled independent agent can assist you analyze the sort of policy with which your industrial lorry must be guaranteed as well as explain the nuanced ramifications as well as insurance coverage effects of having numerous car policies with navigate to this website numerous insurance coverage providers. Some vehicles that are made use of on the farm are guaranteed on personal automobile policies.

Commercial cars that are not qualified for a personal automobile plan, but are utilized specifically in the farming operations supply a minimized danger to insurance provider than their commercial usage equivalents. Some carriers decide to guarantee them on a ranch auto policy, which will have a little various underwriting criteria and also ranking frameworks than a regular industrial car plan.

The Facts About Whole Farm Revenue Protection Uncovered

Kind A, B, C, and also D.

Time of day of use, usage from the home farmResidence and other and also various other constraints use types of kinds. As you can see, there are several types of farm vehicle insurance coverage plans offered to farmers.

The Single Strategy To Use For Whole Farm Revenue Protection

It is essential to discuss your vehicles and also their use openly with your representative when they are structuring your insurance coverage profile. This kind of detailed, conversational strategy to the insurance coverage buying process will certainly help to ensure that all coverage spaces are closed as well as you are receiving the best value from your plans.

Disclaimer: Info and claims provided in this material are indicated for interesting, illustratory purposes as well as should not be thought about legally binding.

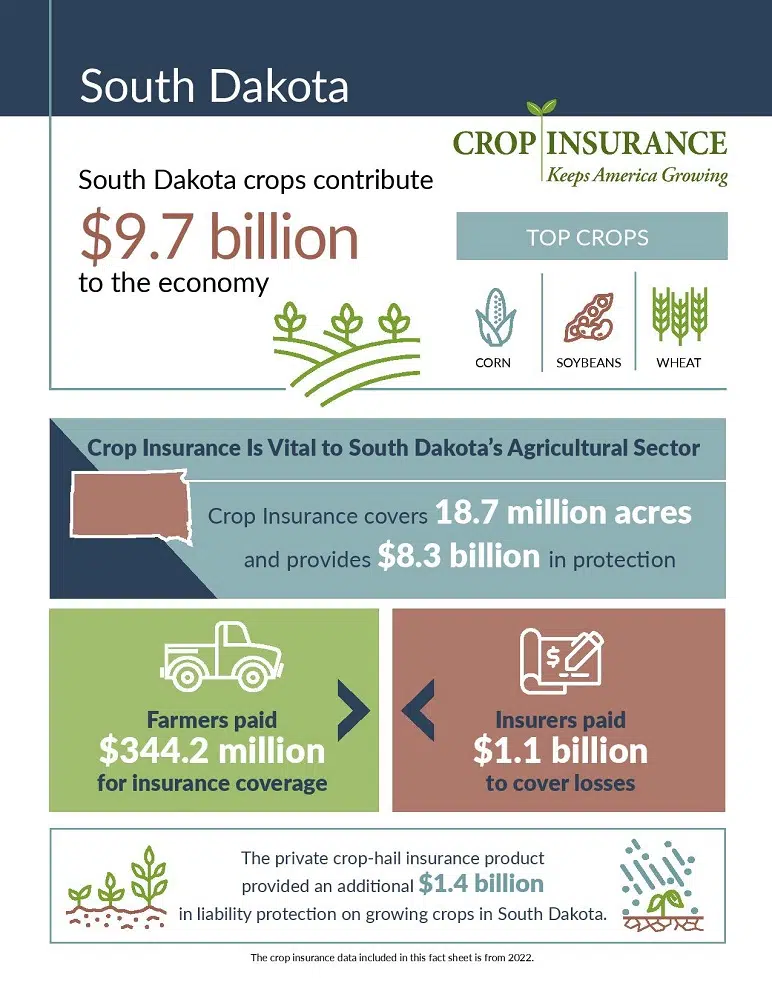

Crop hail storm insurance coverage is marketed by exclusive insurance providers as well as managed by the state insurance policy departments. There is a government program supplying a variety of multi-peril browse around this web-site crop insurance policy items.

Whole Farm Revenue Protection for Dummies

Unlike various other types of insurance coverage, crop insurance coverage is dependent on well-known dates that use to all plans. These are the important dates farmers must anticipate to satisfy: All crop insurance policy applications for the assigned region and also crop are due by this date.